Planned gift will aid Watson College biomedical research

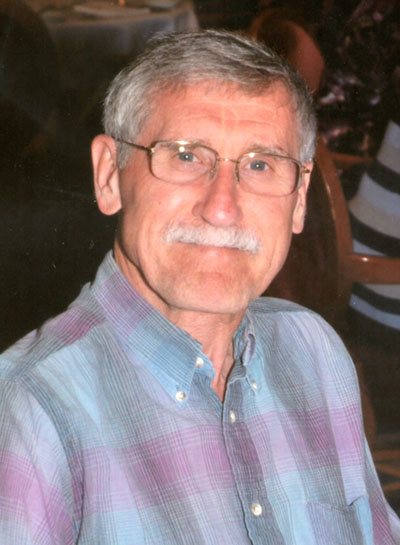

Frank Appell ’68 cites diversity in decision to include Watson in his estate.

Coming to Harpur College in 1965 from a rural environment in Orange County, N.Y., Frank Appell ’68 appreciated the diversity of the budding liberal arts school. That sentiment holds even more true now as his alma mater is a comprehensive university with students from more than 100 countries.

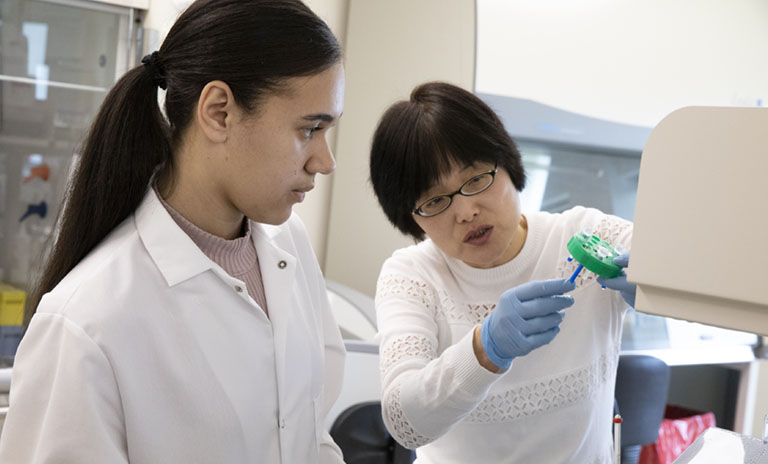

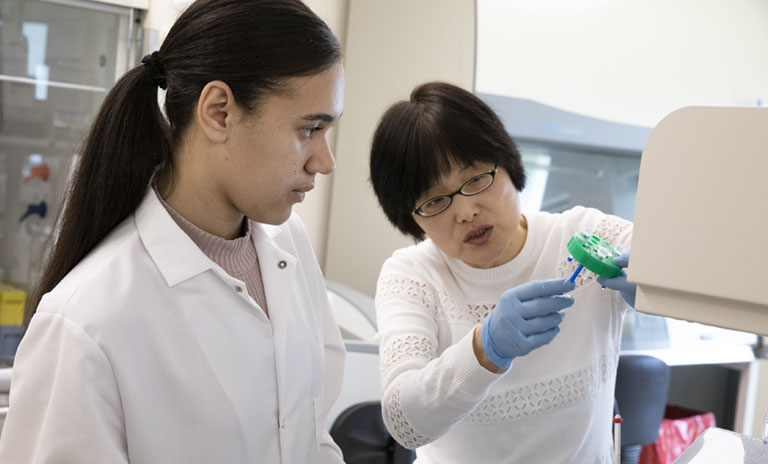

Appell says diversity is why he chose to make a planned gift to the Thomas J. Watson College of Engineering and Applied Science, which started as the School of Advanced Technology near the end of Appell’s time as a Harpur student. Appell has included Watson’s Biomedical Engineering Department in his estate.

“I haven’t been back to campus since 1997, but I’ve kept an eye on what has been happening in Binghamton,” Appell said. “I’m quite amazed at how diverse the academics have become. That’s really wonderful. It’s such a credit to Binghamton. I’ve noticed that in biomedical engineering, the student body is so diverse and I wanted to be supportive of that to the extent that I could.”

The gift could be viewed as surprising given Appell’s academic background and early career endeavors. He majored in German at Harpur and was an English language teacher at Vestal High School before pursuing a master’s degree in library and information science at the University at Albany. When you consider Appell’s present profession—he’s the medical librarian for the Caroline D. Schwartz Medical Library at Good Samaritan Hospital in Suffern, N.Y.—the planned gift to Watson is a perfect fit.

It’s also a way for Appell to meaningfully give back to a school that provided him with a high-quality and affordable education. After one semester in seminary, having decided the priesthood was not for him, Appell attended a college information night at West Point, not far from his home. As the oldest of eight kids, he had to pay for college himself. Harpur was the only school he pursued.

“I wanted a premier education for what I could afford,” Appell said. “Once I left seminary, I quickly applied to Harpur, and started in spring trimester in March 1965. I was delighted with Harpur right away! You were in the country but had access to the town. It felt so comfortable for me. I came to love the academics.

“It was a bit of a leap for me to [make this planned gift]. I don’t necessarily think of it as leaving a legacy. Rather, I want to invest in the future. None of us are here forever, and you want to make sure the future is sound. I had been thinking about doing this for a while, and I finally reached a point where I said, ‘Why not?’ If this motivates one other person to [give to Binghamton], then it’s worth it.”

HOW YOU CAN LEAVE A LEGACY

There are many planned giving options, including some that offer guaranteed lifetime income and some that let you keep your assets now while having an enduring impact tomorrow. Please contact Director of Development Alan Greene ’88 at 607-777-6237 or agreene@binghamton.edu for assistance and additional information regarding minimum requirements to fund scholarships, professorships and other endowed accounts.

HERE ARE THE MOST COMMON FORMS OF PLANNED GIVING

- Wills: A bequest is a gift in your will or trust to the Binghamton University Foundation for the benefit of Watson College. One significant benefit of making a gift by bequest is that it allows you to continue to use during your lifetime the property you will leave to the Foundation. Bequests may be made for a general or specific purpose.

- Charitable Gift Annuities: Through charitable gift annuities, you can convert cash or appreciated securities into guaranteed income for life, gaining financial security while making a significant gift in support of Watson College. You may receive income immediately upon setting up a charitable gift annuity or defer the income, perhaps until your anticipated retirement age, significantly raising the annuity payments and tax deduction.

- Stocks: If someone owns stock for more than one year that has gone up in value, that person can donate the stock to the Binghamton University Foundation for the benefit of the Watson College, get a deduction equal to the fair market value of the stock at the time of the transfer and never pay capital gains tax on the appreciated value of the stock.

- IRA Charitable Rollover: If you are 70½ years old or older, you can take advantage of the IRA charitable rollover and provide a gift up to $100,000 from your IRA directly to the Binghamton University Foundation to benefit Watson College without having to pay income taxes. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions. If you have not yet taken your required minimum distribution for the year, your IRA charitable rollover gift can satisfy all or part of that requirement.

For other forms of planned giving, go online to plannedgiving.binghamton.edu.